HomeNifty option chain with greek excel sheet download

Nifty option chain with greek excel sheet download

₹3,000

₹1,000

Saving ₹2,000

67% off

Product Description

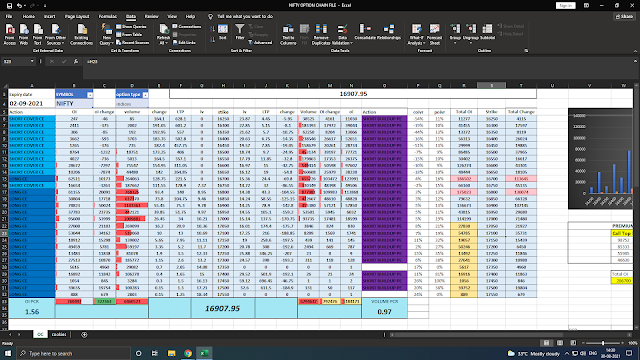

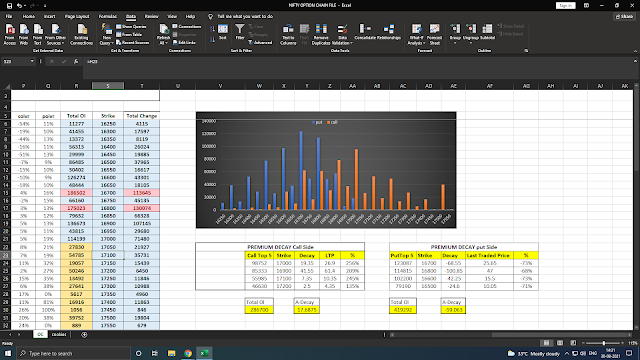

Nifty option chain with greek

This blog will explain different types of options for greeks and share an excel sheet of a nifty option chain with greeks value. Option greeks help us to understand how option price will change as environmental factors change like the stock price - time - the implied volatility.

Different types of option greeks.

Delta.

- Delta is one of the four option greeks and option greeks help us understand how our option positions are expected to perform relative to change in the environment.

- Option greeks delta is the directional risk management of an option and all that means is that delta tells us how much option price is expected to change relative to change in stock price.

- Specifically, option delta tells us the expected price change of that option relative to a 1 points movement in the stock price.

- Delta for a call option is +ve and delta for a put option is -ve

- The maximum value of call delta is 1

- The minimum value of call delta is 0.0

- The maximum value of put delta is -1

- The minimum value of put delta -0.0

- So how do these values affect the selection of option strike?

- let select two delta options 1st delta value Is 0.75 and 2nd delta value is 0.5

- If stock price increase by 10. 1st delta value Is 0.75 option price will increase by 7.5

- If stock price increase by 10. 2nd delta value Is 0.5 option price will increase by 5

- So selection of delta is important to factor and we will upload these values every day in an excel sheet.

- Chose the strike price with a delta of 1 so that you can gain maximum when a stock moves in your direction

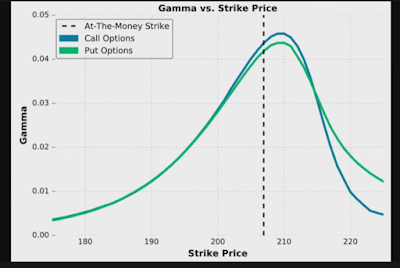

Gamma

- Option gamma tells us the expected change of an options delta when the stock price changes.

- Option gamma is linked with the option delta.

- If option delta is 0.5 and option gamma is 0.05. when a stock moves 1 point new delta will be 0.55.

- Gamma plays important role in deciding the type of risk and fluctuation in option prices.

- If you are an option seller you don't want the fluctuation trades.

- Gamma value is the highest in at the money option.

- Gamma value is highest at the money strike as shown in the picture.

- Strike with 210 has the highest gamma value.

- The option value of strike price 210 will fluctuate more as compared to 200.

- Gamma is also linked with days to expiration

- Stock option with more days to expiration has low gamma value as compared to stock with less day of expiration.

- Let say Gamma of 210 strikes with 14 days to expiration has 0.07 gamma value

- If the stock price moves 1 point delta will change by 0.07

- If the delta was 0.8 and the stock move 1 point new delta will be 0.87

- If delta increased it will also increase the total profit

- If stock move 10 points and quantity is 1000 profit will be 8700

Secure Payments

Shipping in India

Great Value & Quality

Create your own online store for free.

Sign Up Now